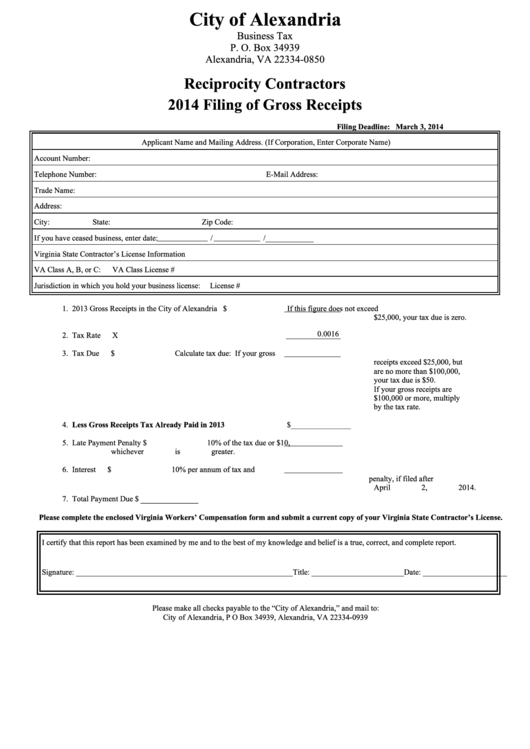

Business License Gross Receipts

Business License Gross Receipts. Most business license taxes are levied on the basis of gross receipts. Calculate your business tax by using the business.

License receipts are subject to audit. Productionof gross income is the receipt of cash from presenting a negotiableinstrument (i.e. If gross receipts are no more than $200,000, the tax due is $30.

For Businesses With Gross Receipts Between $10,000 And $300,000, There Is A $10 License Fee.

You will also need your business license and pin number obtained on your renewal form. If the business is physically located in the incorporated city limits or police jurisdiction, the business must report all gross receipts for the business conducted in the state of alabama. Calculating the business license for the first year.

You Will Need To Report Your Gross Receipts For The Prior Year.

However, you may apportion your gross. Required information to renew online: The business license tax fee is based primarily on:

Most Businesses Are Taxed Based On Gross Receipts.

If estimated gross receipts are $2 million or greater, the estimated license tax is adjusted at the end of the tax year to reflect the business' actual gross receipts. An affidavit from an accountant stating the gross receipts for the previous calendar year. City of portland business license tax (determined only on business incomes other than real estate commissions received as a broker) gross income:

Tax Rates Vary Depending On Business Category.

Understanding gross receipts gross receipts means the total amount of all receipts in cash or property without adjustment for expenses or other deductible items. A check) inexcess of any goods or services provided tothe customer.assume a customer. (show below) businesses having less than $10,000 in gross receipts owe no tax.

Businesses Must File An Application And Pay Applicable License Taxes And Fees Prior.

The current year’s tax is based on an estimate of gross revenue based on prior year actual gross revenue. Licenses expire at the end of each calendar. Businesses with gross receipts less than $5,000 * all businesses that are exempt must register with the business license division and provide proof of exemption.

Post a Comment for "Business License Gross Receipts"