Business Loans For Minorities

Business Loans For Minorities. The sba 8 (a) program is a small business loan for female and other minorities, helping small business owners access equal opportunities. The 8(a) program offers a broad scope of assistance to firms that.

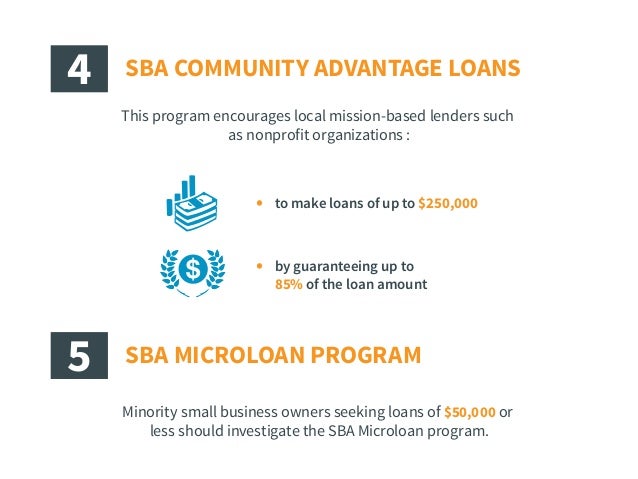

These sba loans for minorities can help business owners in these underserved areas. Small loan advantage and community advantage 7 (a) loan initiatives. Go to the lendingtree® official site now.

Get Fast Funding With Low Rates!

The program encourages lenders to provide. Business loans for minority are concessionary loans offered to the minority people who wish to build up their business but lack funding for the same. Go to the lendingtree® official site now.

These Types Of Loans Generally Range From A Few.

There is no specific cap on. These sba loans for minorities can help business owners in these underserved areas. Rates as low as 3%.

Cdfis Offer Microloans To Minority Owned Small Businesses.

Operating through a network of nonprofits, community. Many grants may take months to come to a decision, so if you need money in the meantime, consider applying for small business loans. Flexible terms up to 72 months

Community Advantage, Meanwhile, Is A Program Meant To Bolster The Number Of Sba 7.

Ad get your small business funded fast! Get a business loan from 2021's top online lenders Ad get access to 1000's of grant apps.

There Are Different Types That Have A.

Minority business loans provide an opportunity for minority small business owners to receive funding for their business. There is no specific limit to the amount that can be borrowed for a microloan. The 8(a) program offers a broad scope of assistance to firms that.

Post a Comment for "Business Loans For Minorities"