Business Valuation Ebitda Multiple

Business Valuation Ebitda Multiple. For example, a car dealership’s ebitda is $600,000. So, when you're considering what a company is worth,.

Business value based on net. Often when you just start researching the subject of “business valuations by industry” you’ll hear talk of selling multiples on revenue, net income or ebidta, and then talk of how to value. It’s best to use it when we benchmark businesses within the same.

Sign Up Now For Your Free Value Assessment.

The multiples approach to valuing. Ad more buyers, more bids & higher prices. Mvic/sales mvic = 14,213.00 3.2x sales 4,379.00 in the above example, the mvic of $14,213 (million) is divided by the sales of $4,379.

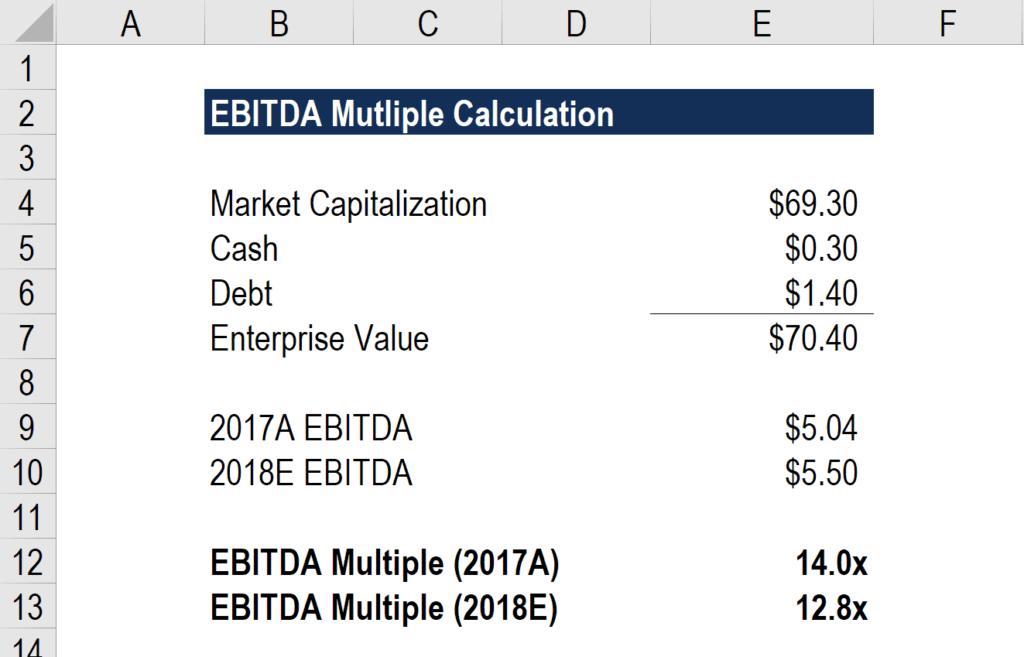

Ebitda X Multiple = Value Of The Business.

What is ebitda business valuation multiple? Focusing on operational improvement, therefore, ensuring operations are running as efficiently as possible, enhances ebitda, and creates greater value and a higher multiple for the business. The hadley capital business valuation calculator applies a multiple of ebitda to determine the enterprise value of your business.

Here, We Will Focus On The Multiples Approach, Which Follows Two Steps:

Learn the value of your company today. (million) to derive an ebitda multiple of 14.1 times. • all operating assets (ff&e) •all intangible assets (goodwill) the value of a business includes:

The Ebitda (Earnings Before Interest, Tax, Depreciation, And.

Often when you just start researching the subject of “business valuations by industry” you’ll hear talk of selling multiples on revenue, net income or ebidta, and then talk of how to value. Valuation analysts use multiples as financial measurement tools to compute the value of a company and compare it to similar companies. ‘multiple’ as such means a factor of one value to another.

For Example, A Car Dealership’s Ebitda Is $600,000.

Using the above calculation, the car. Ebitda, so multiples based on the former will naturally be lower, but sde multiples for small businesses also reflect significantly greater risk vs the s&p 500. There are a several ways to determine the value of a business.

Post a Comment for "Business Valuation Ebitda Multiple"