Business Owner W2 Or 1099

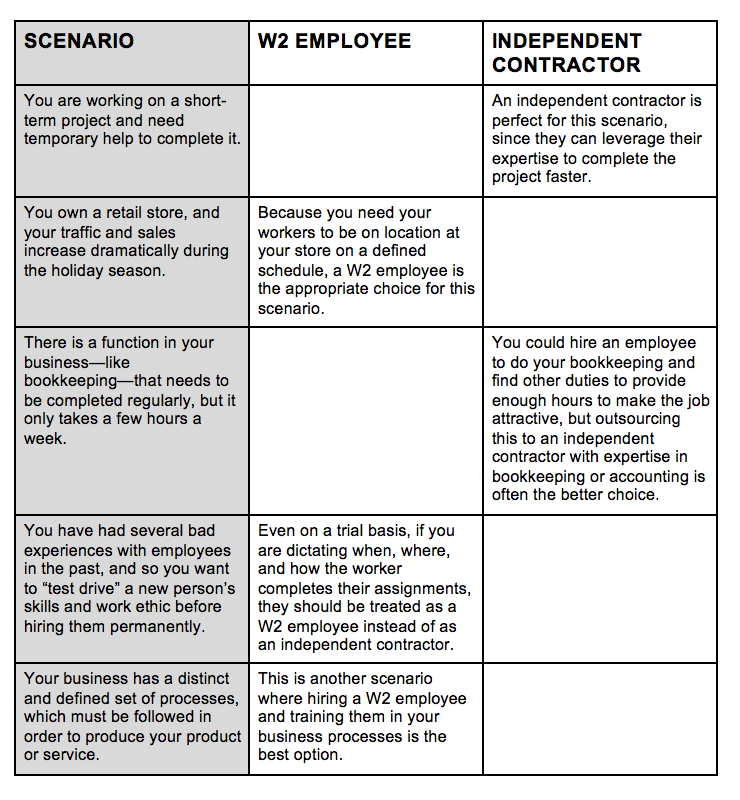

Business Owner W2 Or 1099. Employers have control over the services that w2 employees perform, while 1099 workers have more independence and can decide what is done and how. If you are responsible for reporting information on employees’ social security, medicare taxes, and.

Use with any web browser in minutes When it comes to taxes, the most expensive fees you could pay could be from. The irs gives guidelines on what constitutes an employee, and if you ignore that and someone complains, then you may get penalized.

Employers Have Control Over The Services That W2 Employees Perform, While 1099 Workers Have More Independence And Can Decide What Is Done And How.

Here are a few things to look for: You must file an 8832 form in order for the llc to be considered a corporation. When it comes to taxes, the most expensive fees you could pay could be from.

As A Small Coworking Space Business Owner Or An Entrepreneur Preparing To Hire Your First Employees, You Might Be Wondering Whether It Pays To Include Them In Your Payroll Or.

When you file self employed w2 or 1099 forms, you need to make sure you know the guidelines. This view allows for an easier method of tax collections. The trend has been for the irs to view all helpers under the direct control of a business owner as their employees not as contractors.

Most Of Us, Though, Will See The Vast Majority Of Our Income Reported On Either A W2 Form Or A 1099 Form — Because We Are An Employee, A Freelancer, Or A Contractor.

Ad the premier 1099 online filing solution. It's not so much a business choice. The type of relationship an employer has with its employee helps determine a w2 vs 1099 employee.

All Income And Deductions From The Schedule.

The irs gives guidelines on what constitutes an employee, and if you ignore that and someone complains, then you may get penalized. Use with any web browser in minutes If it’s an owner’s draw, it is not put on a 1099.

If You Are Responsible For Reporting Information On Employees’ Social Security, Medicare Taxes, And.

The amount of control you. 1099 vs w2 workers have their own unique sets of pros and cons. These workers are business owners themselves who provide set services to your company and are not on your payroll like a company employee.

Post a Comment for "Business Owner W2 Or 1099"