Good Business Judgement Rule

Good Business Judgement Rule. It will go through the structure of the rule, as well as famous examples and new modifications of it. First, that directors should be given wide latitude in their handling of corporate affairs because the hindsight of the judicial process is an imperfect device for evaluating business decisions.

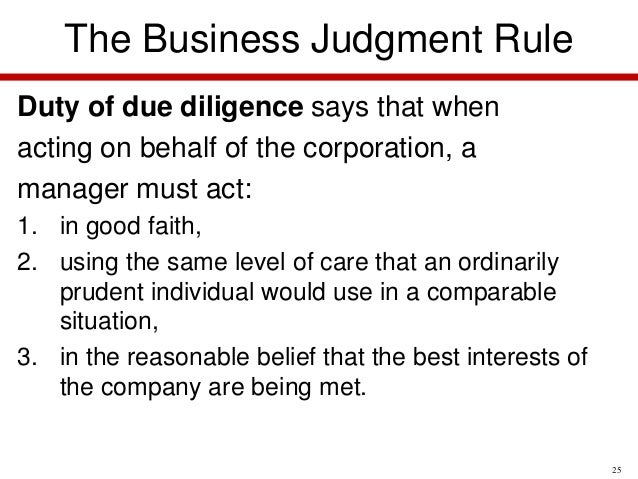

As a part of a condominium or homeowner association, board members have a fiduciary duty, or obligation to act in the best interest of the association and its unit owners. In the 1980s delaware courts began assigning the business judgment rule a more expansive role. Business judgement rule (bjr) is a presumption that directors, by default, act while (1) sufficiently informed, in (2) good faith, and with (3) an honest belief that they have the best interest of the corporation and stockholders in mind.

It Is Rooted In The Principle That The Directors Of A Corporation.

The traditional business judgment rule applies when directors are reasonably informed about their decision, disinterested and independent, and acting in good faith. It will go through the structure of the rule, as well as famous examples and new modifications of it. The business judgment rule is an important caveat to the corporate duty of care owed by officers and directors to their companies.

The Business Judgment Rule Is A Crucial Principle For Corporate Directors And Shareholders To Understand As It Protects The Jobs And Assets Of Each Respectively.

The business judgment rule takes steps to further protect directors from liability for their decisions or actions if they acted in good faith. Therefore, to survive a motion. Corporations code §7231 (a) protects directors from personal liability if they make decisions that result in damage or loss to others, provided their decisions were made:

The Business Judgment Rule Is A Presumption In The Law That Favors The Board Of Directors Or Managers Of A Company.

Claims of negligent mismanagement are viable only when some exception to the business judgment rule applies. Under the business judgment rule, courts rebuttably presume that directors are acting in good faith, with good information, and that their actions will benefit the corporation. Are clothed with presumption, which the law accords to them, of being in their conduct by a bona fide regard for the interests of the corporation whose affairs the.

The Duty Of Care Requires Directors And Officers To Act In As Competent A Manner As Would Reasonably Prudent People In Their Positions.[1] Officers And Directors Must Make Decisions That They Believe, In Good Faith, To Be In The Best Interests Of.

Basically, it raises the standard of care for holding a director liable for actions or decisions that cause a loss to the corporation. It generally shields directors from personal liability that may result from their decisions, provided that the decision was made (1) with care, (2) in good faith, and (3) was based upon what the director believed to be in the best interest of the association. In good faith (the business judgment rule immunizes directors from good faith mistakes in judgment.

The Business Judgment Rule Has Been Justified Primarily On Two Grounds.

The “modern business judgment rule” is applied not only in cases when the board of. Business judgement rule (bjr) is a presumption that directors, by default, act while (1) sufficiently informed, in (2) good faith, and with (3) an honest belief that they have the best interest of the corporation and stockholders in mind. However, the business judgment rule can only be used if all the requirements as set out in the act are complied with.

Post a Comment for "Good Business Judgement Rule"