Uber Qualified Business Income Deduction

Uber Qualified Business Income Deduction. Actually the idea for this was to make an even playing field for small businesses vs large corps. This includes only items that are taxable income and are connected with a trade or business in the united states.

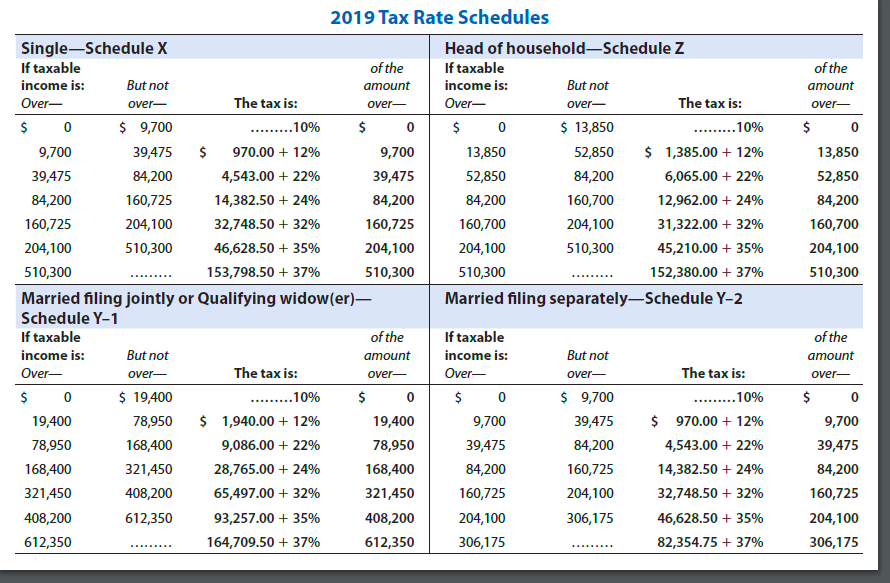

For instance, a single uber driver, without kids and earning $26,000, will see about $623 tax savings on their 2018 taxes due to the 20% deduction from qualified business. If you are reporting business income on your 1040, you can deduct 20% of net qualified business income. For 2019, the standard deduction was $12,200 for people filing as single, and in 2020, that deduction will rise to $12,400.

You May Deduct Up To 20% Of Your.

Second, the income must come from a domestic business. If you are reporting business income on your 1040, you can deduct 20% of net qualified business income. I am an uber driver, is this income “qualified business income”.

Corporations (C Corps) Had Their Tax Rate Lowered, The 199A Deduction Is A Reward To Small Businesses Because Their Tax Rates Were Not Lowered.

If your taxable income is over $207,500 ($415,000 mfj),. What is susan's qualified business income deduction? She earned about $1070 in 2018 and had no other income.

Third, There Are Income Restrictions.

The qualified business income deduction is restricted because her taxable income ($20,000) is lower than her qualified business income ($40,000). Do uber drivers qualify for qualified business income deduction? Last week, we discussed the qualified business income (qbi) deduction and provided an example of how the deduction works if your individual taxable income is under certain thresholds ($315,000 for married filing jointly taxpayers and $157,500 for all others).

For Instance, A Single Uber Driver, Without Kids And Earning $26,000, Will See About $623 Tax Savings On Their 2018 Taxes Due To The 20% Deduction From Qualified Business.

The rules about who can take the deduction and about what constitutes qualified business income are located in section 199a of the internal revenue code. Yes, rideshare drivers are eligible for the new 20% deduction. For your 2021 taxes, which you'll report during the 2022 tax season, you can claim the full qbi deduction if your taxable income falls within these thresholds:

This Includes Only Items That Are Taxable Income And Are Connected With A Trade Or Business In The United States.

There is a qualified business income deduction for small business owners. Uber drivers, lyft drivers, freelancers and other independent contractors will be able to deduct 20 percent of their income from their taxable income before paying the new lower tax rates. Uber didn't send her 1099 as she didn't meet earnings threshold.

Post a Comment for "Uber Qualified Business Income Deduction"